HSA/FSA Payments Simplified

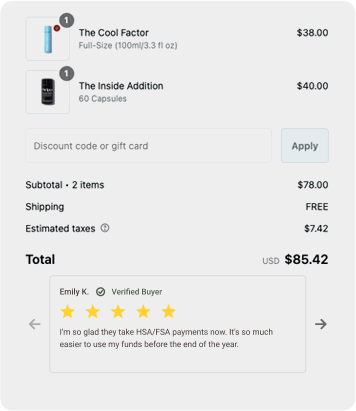

Add products to your cart

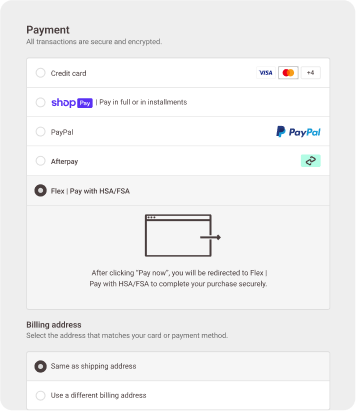

Select flex at checkout

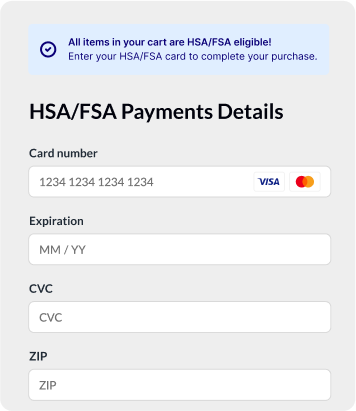

enter with your hsa/fsa card

*Qualified Products

What is a qualified customer?

The IRS oversees HSA and FSA eligibility and dictates that a customer must have a medical condition or disease that they are seeking to treat or manage with LIT equipment. Customers must have documentation that confirms their eligibility, also called a Letter of Medical Necessity. Not to worry, LIT has partnered with Flex to make this a quick and easy process for you.

How do I use my HSA/FSA to pay for LIT?

At checkout, select Flex | Pay with HSA/FSA as your payment option. You will be prompted to complete a brief Telehealth consult to confirm your eligibility to pay with HSA/FSA. From there, enter your HSA or FSA debit card details and complete your checkout as usual.

Within 24 hours of your purchase, Flex will email you both a Letter of Medical Necessity as well as an itemized receipt. Keep these documents for your records should your HSA/FSA provider or the IRS require additional documentation.

FAQ

What is an FSA or HSA and what are the benefits?

An FSA (Flexible Spending Account) and an HSA (Health Savings Account) are tax-advantaged accounts for medical expenses but differ in key aspects. FSAs, employer-sponsored, allow employees to use pre-tax dollars for medical expenses such as prescriptions and copays, but typically feature a "use-it-or-lose-it" policy where funds must be used within the plan year. HSAs are available to those with a high-deductible health plan and offer more flexibility, allowing funds to roll over annually.

For more information, see Flex’s Comprehensive Guide to HSA/FSAs

How can I spend my FSA or HSA funds on Stripesbeauty.com website?

At checkout, select “Flex | Pay with HSA/FSA'' at checkout (do not use Shop Pay). You will be prompted to complete a brief Telehealth consult to confirm your eligibility to pay with HSA/FSA. From there, enter your HSA or FSA debit card details and complete your checkout as usual.

I’m not seeing HSA or FSA options show up at checkout. Why not?

If you are logged into "ShopPay" Please make sure you checkout as a "guest". This will allow you to see all of our payment options. Or, none of the items in your cart may be HSA or FSA eligible. Reach out t customercare@stripesbeauty.com if you think there is an error.

I keep being pushed into Shop Pay. How do I use my HSA/FSA card?

If you continue to be pushed into the ShopPay checkout, we recommend completing your purchase in an incognito window.

Why was my HSA or FSA card rejected?

Like any credit or debit card, HSA/FSAs can be declined if any of the data from the card is incorrect (number, expiration date, zip code etc). Flex will alert you in checkout if any of these fields is missing or incorrect so you can update them.

The most common reason for rejection of the card is insufficient funds. Reach out to your HSA or FSA provider to verify the amount of money in your account before attempting to complete your purchase again.

I don’t have an HSA or FSA card. Can I still use my HSA/FSA funds?

Yes, you can still be reimbursed for the expense. Select “Flex | Pay with HSA/FSA” at checkout. Instead of entering your HSA or FSA card, input your regular credit card. Flex will email you an itemized receipt following your purchase. Submit the itemized receipt to your HSA or FSA provider for reimbursement.

What is a Letter of Medical Necessity?

A Letter of Medical Necessity (LOMN) is a document written by a healthcare provider that explains why a specific medical service, treatment, or equipment is necessary for a patient's health. In relation to an HSA (Health Savings Account) or FSA (Flexible Spending Account), an LOMN is often required for reimbursement of expenses that are not clearly defined as eligible under the standard IRS guidelines.

Who is Flex and what is their relationship with Stripes Beauty?

Flex has partnered with Stripes Beauty to enable consumers to use their HSA/FSA funds. You can think of Flex as an alternative to payment method, similar to ShopPay or Paypal.

Do I need to check with my HSA/FSA provider before purchasing?

We strongly recommend checking with your HSA/FSA provider to see if a purchase is eligible prior to completing the purchase. Please note that employer-sponsored FSAs can determine what products are eligible beyond the IRS’s guidelines, so it’s extremely important to check prior to purchase.